BUSINESS AT

THE PORT

An Aviation, Manufacturing & Technology Hub

The Port of Moses Lake is an aviation, manufacturing, and technology hub in the Pacific Northwest. Home to Grant County International Airport, one of the largest airports in the Western United States, the Port is surrounded by greenfield land and low population density.

Site Selection

Everything needed for Business: As a major hub in rural central Washington, the Port of Moses Lake connects people and products to a global marketplace. The Port and its partners, including Grant County, Grant County Economic Development Council and the City of Moses Lake, collaborate closely to optimize benefits, incentives, and perks for site-seeking clients.

- World class with uncluttered airspace

- Five runways, the longest being 13,503 feet by 200 feet

- 350 days of good flying weather: “Visual Flight Rules”, or “VFR” in aviation parlance

- FAA control tower and radar facility (Terminal Radar Approach Control - TRACON)

Labor Area Summary

March 2024 county-level employment figures and unemployment rates for Washington's 39 counties were released on Tuesday, 23 April 2024 by ESD. The attached March 2024 edition of the Grant County Labor Area Summary (LAS) analyzes current not seasonally adjusted nonfarm employment and Civilian Labor Force (CLF) data for Grant County with a focus on changes between March 2023 and March 2024 and on average annual changes between 2022 and 2023. Full Report

Donald W. Meseck, Regional Labor Economist Employment Security Department

Kittitas County WorkSource, 510 N. Pine Street, Ellensburg, WA 98926

Phone: 509-607-3267

Email: don.meseck@esd.wa.gov

Website: https://esd.wa.gov/labormarketinfo

Incentives & Financing

In support of its mission to promote economic vitality and diversify the region’s economy, the Port and its partners are committed to creating and maintaining an environment that is financially appealing for companies.

- Active Foreign Trade Zone (FTZ)

- Located in a State Opportunity Zone and Industrial Development District (IDD)

- Manufacturing sales & use tax incentive

- Food manufacturing B&O tax exemption for qualifying activities

- Rural county B&O tax credit for new employees

- Reduced B&O tax rate for aerospace businesses

- The Port keeps track of financial assistance opportunities directly for, or on behalf of development related to new or expanding business

- Close collaboration with economic development partners across the region.

Multi-Modal Connectivity

- The Port of Moses Lake is only seven minutes from Interstate 90, providing direct access to the national interstate network. This connection provides businesses with linkage to the marine ports of Seattle and Tacoma for import and export of crucial cargo.

- Rail loading facilities in town at one of our Foreign Trade Zone (FTZ) partners allows for swift movement of containers or bulk commodities across the US. In 2025, construction of a spur off the NCBR line will reintroduce uninterrupted rail access onto Port properties.

- The Grant County International Airport is large enough to accommodate cargo or commercial aircraft of any size, allow for loading and unloading of oversize freight as well as providing service to technical stops or diverted aircraft.

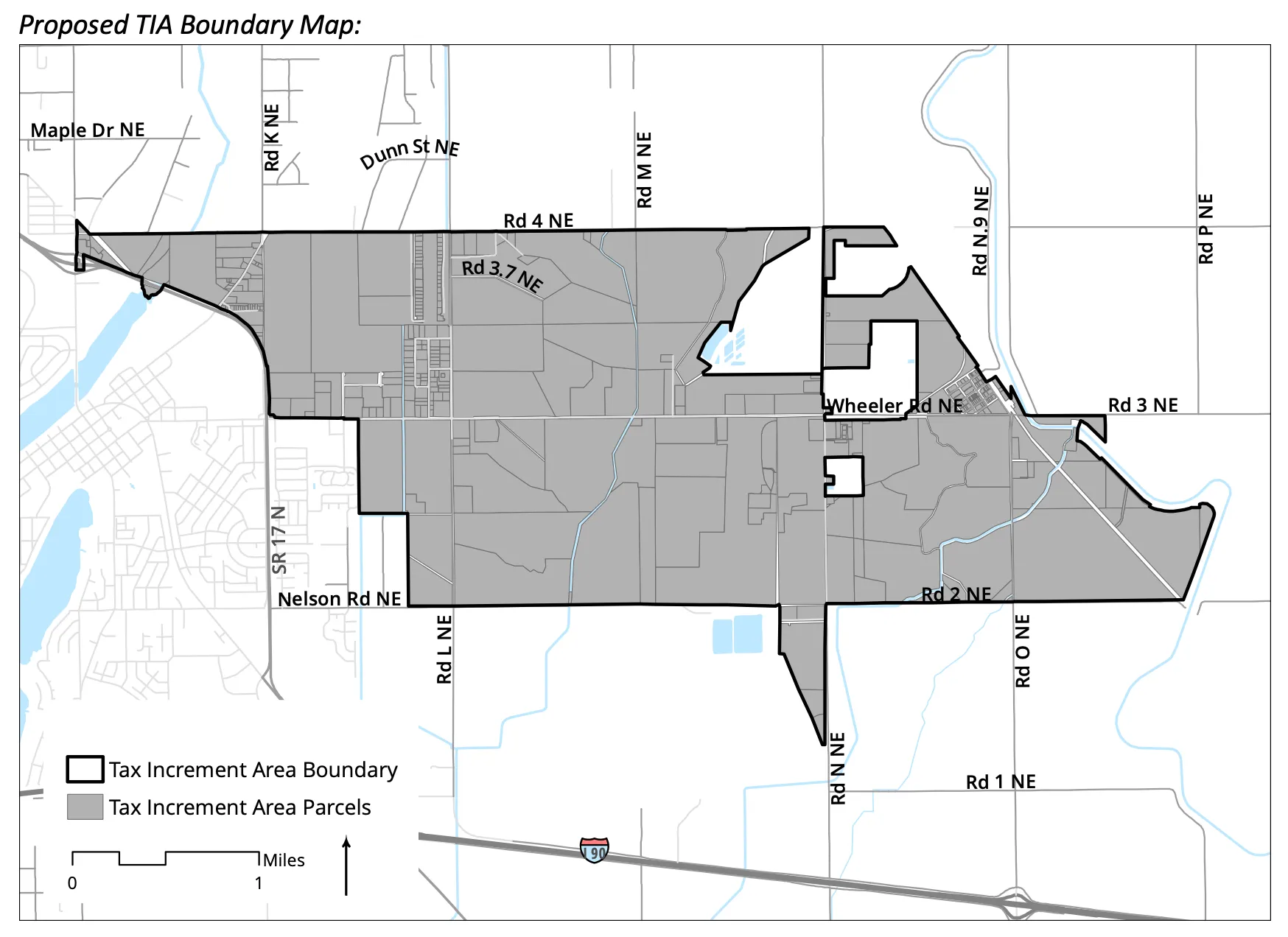

Tax Increment Area

The Port of Moses Lake Commissioners officially signed the "Tax Increment Area Resolution" at 10am on Monday, May 13, 2024 at a regularly scheduled Commission Meeting. Adopting the Tax Increment Financing (TIF) assists in funding economic development projects intended to enable new economic growth in our community.

TIF funding is not a new tax. The funding comes from the new property tax revenue generated by the growth in assessed value for properties located in a Tax Increment Area (TIA). Existing property tax revenue continues to be collected by the current taxing districts. Taxing districts temporarily forego some taxes raised from the increase in assessed value in the TIA, and the dollars are invested in public infrastructure improvements in the TIA. The intent of a TIA is to fund public projects that stimulate growth in assessed value that would not occur without those public projects. Thus, a portion of the foregone tax revenue would not exist without the TIA investments. Although this is not a new tax, there is a very small impact on local property tax rates projected.

Establishing a TIA may result in slight changes to the calculation of existing property tax levy rates, including slight increases for some levies and slight decreases for others. For instance, the increase in taxes on a property valued at $100,000 is estimated to be approximately $1.20 per year. This is anticipated to be partially offset by reductions in school tax rates. A TIF does not negatively impact school funding. Private development anticipated to occur as a result of public improvements within the proposed TIA would generate increased property tax revenues for state school funding and reduce the levy rate for local school levies.

Port staff have identified a preliminary list of eligible activities that would support continued taxable new development within the proposed TIA within the following broad categories:

- Transportation Improvements

- Wastewater Improvements

- Water Improvements

- Power Improvements

- Life and Safety Improvements

- Land Use - Environmental Improvements

The total estimated economic impacts (direct, indirect, and induced) from the construction phase are 16,211 Full Time Employment (FTE) positions and $1.03 billion in labor income (2024 dollars). The overall increase in employment in the proposed TIA is estimated to be 15,118 FTE when completed and tenanted.

The Port participated in outreach throughout early 2024 to educate the community and seek input on the TIA. The Port of Moses Lake Tax Increment Area Project Analysis Report provides additional detail on the TIA, and is available here.

The Port of Moses Lake has adopted Tax Increment Financing (TIF) as a strategy to accelerate the Columbia Basin Rail project and various infrastructure enhancements, facilitating job creation and promoting economic development. Read more below.

- Frequently Asked Questions

- Boundary Map

- Projects

- Goals and Objectives

- Project Analysis Report

- Tax Increment Area Resolution

For more information, please email Richard Hanover, Director of Business Development, or Dan Roach, Executive Director, Port of Moses Lake.

W20 Lateral Extension Water Project

Clean Reliable Water. Secure Future.

The W20 Project is a locally led water infrastructure initiative designed to deliver region-wide benefits for Grant County and the greater Columbia Basin. Driven by collaboration among local stakeholders, the project strengthens municipal water supplies, improves water quality, and provides important operational capacity for the Columbia Basin Project.

By investing in smart, integrated infrastructure, the W20 Project creates a rare set of win-wins that serve municipal, industrial, environmental, and agricultural needs simultaneously – for generations to come.

The W20 Project is supported by committed partners, united around a shared vision of clean, reliable water for a secure future. Partners include Western Pacific Engineering, Grant County, Columbia Basin Conservation District, the City of Moses Lake, Moses Lake Irrigation and Rehabilitation District, Columbia Basin Sustainable Water Coalition, Moses Lake Watershed Council, Columbia Basin Development League, and the Port of Moses Lake.

Learn more at: w20project.org

Northern Columbia Basin Railroad Project (NCBRP)

Your privacy is important to us.

This website uses cookies to provide you with a better browsing experience. We also use these technologies to measure results and to understand demographics of our site visitors. For more information, please read our Privacy Policy.